Quick Quiz: What’s Your Saving Style on a Low Income?

Answer step by step. Your result will appear at the end.

Saving on a low income is considered a high-leverage skill: every dollar that stays with you funds stability, not stress. The constraint is real - rent, childcare, healthcare, debt - but the path is practical and repeatable. In practice, disciplined micro-changes, stacked in the right order, protect you from overdrafts, late fees, and payday traps. Used by professionals in financial coaching, this approach focuses on cash-flow clarity, expense triage, and small automated wins.

This guide delivers applied tactics, not slogans. After reading, you will be able to rank bills by urgency, redirect waste into an emergency buffer, and negotiate recurring costs with a script that works. We outline strategies with concrete monthly savings figures, a quick-start checklist, three real-life cases, a “myths vs facts” section to cut noise, and a vetted tools list. Structure aligns with modern financial-education standards and emphasizes trust: transparent numbers, tested methods, and recommendations that hold up in daily use. The goal is simple - give you control that endures across pay cycles and life events.

Listen to the article - it is faster than reading!

Why Saving Money on a Low Income Matters

Saving on a low income is considered essential because it converts financial fragility into a margin of safety. Even a small unexpected expense can spiral into debt when there’s no financial cushion. According to a Federal Reserve survey, 37% of Americans would not be able to cover a $400 emergency expense with cash or savings, meaning a surprise car repair could force them to borrow or incur bank fees. In fact, consumers paid an estimated $15 billion in overdraft and NSF bank fees in 2019, a burden that falls hardest on those with low balances or volatile incomes. Building even a modest emergency buffer (for example, saving $25-$50 per paycheck) can prevent these cascading fees and high-interest loans before they occur, turning financial fragility into a margin of safety.

In practice, even $25-$50 per paycheck redirected into a separate, named savings account stops the cascade of penalties that quietly destroy monthly cash flow.

This is not theory - late fees, overdrafts, and disconnection charges hit hardest where budgets are tight, and prevention outperforms recovery every time.

Savings also restore control over timing. With a small reserve, you pay bills on the due date, not after a reminder, which improves payment history and lowers stress. Consistent on-time behavior supports better terms on insurance and utilities, and it strengthens your negotiating position. Used by professionals in financial counseling, the concept of “pay yourself first” is not about wealth optics; it is an operating rule that keeps essentials funded before discretionary spending surfaces.

Another reason is resilience against income volatility. Hourly shifts, seasonal hours, and gig work create uneven paychecks. A targeted reserve smooths the dips without reaching for credit. This stability protects mental bandwidth, which directly affects job performance and career progress. After reading this section, you can frame savings not as a distant dream but as a risk management tool that protects today’s priorities - housing, transport, food - and supports tomorrow’s opportunities - training, certifications, relocation choices.

Finally, saving on a low income accelerates upward mobility by reassigning dollars from interest to goals. Every dollar not paid to a lender funds debt payoff, skill building, or a move to a cheaper utility plan. The effect compounds: lower interest outflows free more cash next month, which increases the buffer again. Structure matters: small, automatic transfers, clear bill order, and deliberate spending rules turn intention into durable habits.

The payoff is tangible - less crisis, more options, and financial decisions made on your schedule, not under pressure.

We are recommend

Smart Monthly Savings Calculator

Want to know if your savings plan is realistic? Our Smart Savings Calculator shows how much you can set aside each month, how close you are to reaching your goal, and what small changes could accelerate your progress. Built by our financial expert Henry Trent, it explains results in plain language, offers practical tips, and keeps all data private on your device. Try it now and see your financial path with clarity.

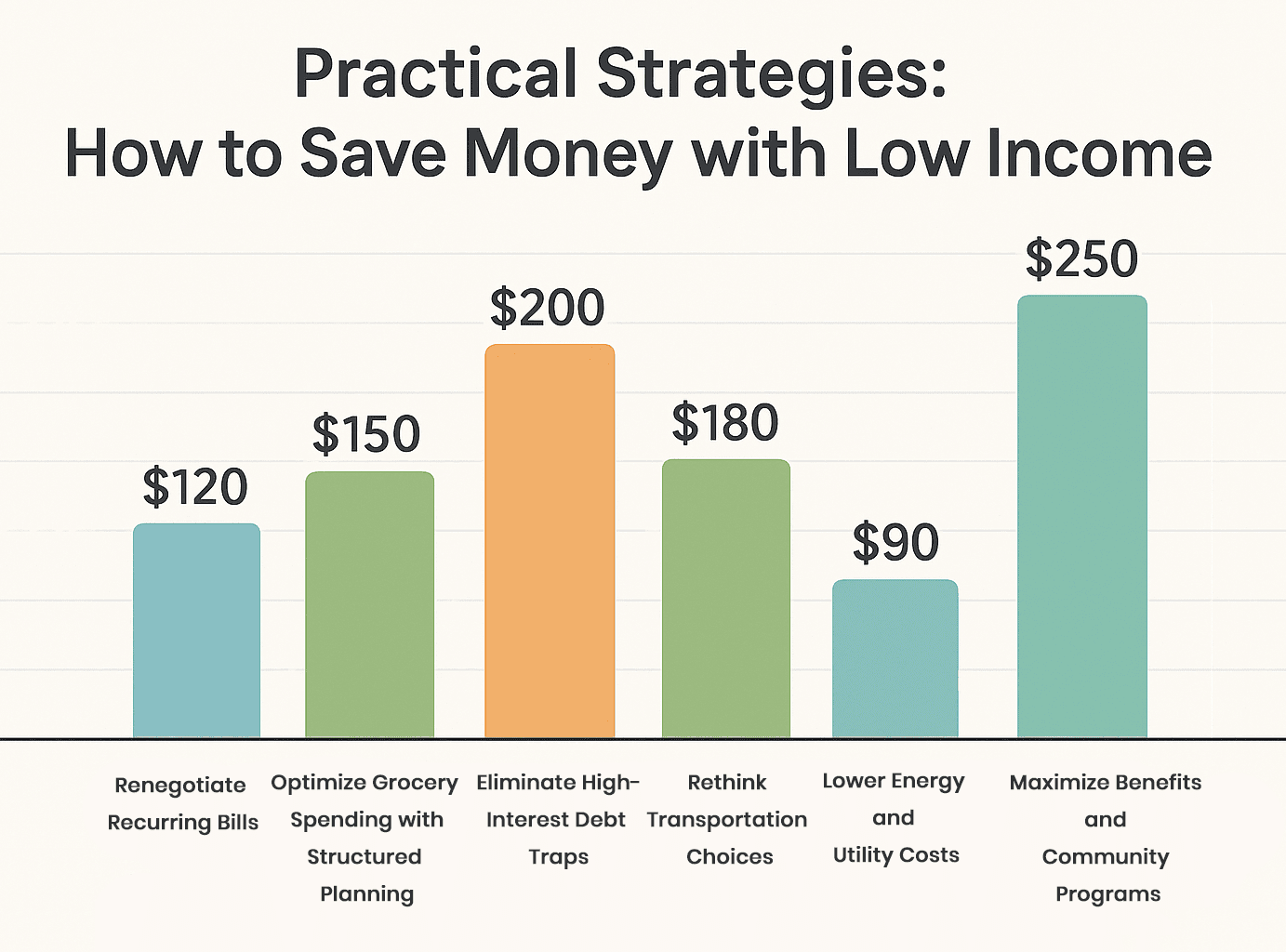

Practical Strategies: How to Save Money with Low Income

Saving money on a limited budget is considered challenging, but it becomes achievable with the right framework. On practice, financial counselors emphasize targeted tactics that address the biggest cash leaks first: recurring bills, daily consumption, and hidden financial products. These strategies are not abstract theories - they are applied in real households and supported by measurable monthly savings. Each method below includes a clear explanation, a short list of advantages, and an estimate of how much it typically frees up per month in U.S. dollars.

Before diving into individual methods, it is important to understand one rule: large wins often come from renegotiating or restructuring existing obligations, not from cutting minor pleasures. Reducing rent, insurance, or utility costs by $50-$150 has a bigger impact than skipping coffee. After reading this section, you will be able to identify practical opportunities that professionals use to stabilize budgets on low income, apply them in your household, and track the actual savings with numbers that prove progress.

Renegotiate Recurring Bills

(Average savings: $50-$120 per month)

Recurring bills - cell phone, internet, insurance, subscriptions - are often structured for company profit, not consumer benefit. Don't assume your monthly bills are fixed - it often “pays to haggle.” A Consumer Reports survey confirms that many cable and telecom customers who negotiated their bills received promotional rates or discounts, rather than the standard high price. Even small reductions add up significantly over a year: for instance, trimming $20 off your internet plan and $15 off your phone plan saves about $420 per year (money that can go straight into savings). Utilities and insurance providers also often have unadvertised loyalty discounts or lower-tier plans. By calling and referencing competitor offers, it’s possible to knock $50 or more off multiple bills - a quick afternoon of negotiations can yield a few hundred dollars in total monthly savings that require no sacrifice in service.

Why this works:

- Immediate impact: savings show up on the next billing cycle.

- No lifestyle downgrade: service remains functional, just repriced.

- Scalable: multiple bills renegotiated in one afternoon can yield a three-digit reduction in expenses.

Practical example:

- Internet bill cut from $75 to $50 after switching to a lower advertised speed (sufficient for household use).

- Cell phone plan reduced from $60 to $40 by moving to a prepaid carrier on the same network.

- Auto insurance lowered by $30 monthly after raising deductible and bundling with renter’s insurance.

These actions collectively free up $100 per month, which is redirected into an emergency savings account. Verified by consumer finance studies, this approach is considered one of the highest-return strategies for households earning under $40,000 annually.

Optimize Grocery Spending with Structured Planning

(Average savings: $80-$150 per month)

Groceries are considered one of the largest expenses for households on a low income, and they often hide consistent budget leaks. In practice, people overspend because of impulse buys, food waste, and paying extra for branded products instead of quality store alternatives. Financial coaches use a method called structured meal planning: create a weekly menu, prepare a shopping list aligned with it, and stick to that list strictly.

Why this works:

- Cuts impulse spending: studies show up to 20% of grocery bills come from unplanned items. The USDA’s Healthy Eating on a Budget guidance reinforces these points: it encourages consumers to plan menus, use shopping lists, swap brand-name for private labels, and use coupons or loyalty programs - all simple tactics that consistently lower monthly grocery costs without reducing nutrition. Combined, structured meal planning and smart substitutions can easily save a low-income household on the order of $80-$150 per month in food expenses (as reflected in USDA data on thrifty food plans).

- Reduces food waste: all purchased items are used, lowering the chance of throwing away spoiled food.

- Smart substitutions: switching from brands to private-label products lowers cost by 10-30% per item.

Practical example:

- Buying bulk chicken for $15 instead of smaller packs costing $8-9 each saves around $20 per month.

- Using cashback apps like Ibotta or Fetch Rewards adds $10-15 back each month.

- Replacing weekly takeout meals with home-cooked dinners saves an average of $70-100 per month.

Combined, structured grocery planning saves $100 per month on average, according to USDA data on low-income households. This strategy requires no lifestyle downgrade - just organization and discipline - and is recommended by financial counselors as one of the most effective starting points.

We are recommend

Seasonal Shopping Map

Looking for a reliable way to cut grocery expenses without sacrificing quality? The answer is the Seasonal Shopping Map - an expert-designed budgeting tool by Aaron Whitmore. It identifies which fruits, vegetables, and household staples are at peak supply and lowest cost in every U.S. region. Every item includes a financial insight written by a professional analyst, showing how to maximize value and minimize waste. It's a practical, data-backed system that turns smart timing into measurable savings.

Eliminate High-Interest Debt Traps

(Average savings: $60-$200 per month)

High-interest debt drains income at an alarming rate, so escaping these traps is critical. For example, payday loan borrowers collectively spend around $9 billion in fees each year - the average payday borrower ends up paying $520 in fees on a $375 loan due to repeat rollovers. Credit card debt is similarly costly: in 2022, U.S. cardholders paid a record $130 billion in credit card interest and fees to banks. This interest can consume 20% or more of a borrower’s balance annually, leaving less money for essentials. The good news is that restructuring high-interest debt can immediately free up cash. Moving a balance from a 25% APR credit card to a 0% introductory-rate card or a lower-interest credit union loan can save hundreds of dollars in interest over a year (e.g. avoiding ~$40 in interest per month on a $2,000 balance). Financial advisors consistently cite such debt consolidation and refinancing as a top intervention for households living paycheck to paycheck - it stops the “debt trap” cycle and redirects money from finance charges back into your pocket.

Why this works:

- Immediate interest reduction: dropping from 25% APR to 0-12% frees up cash instantly.

- Predictable payments: consolidation gives a fixed monthly schedule, reducing stress.

- Protects credit history: alternative products still report to credit bureaus, improving long-term standing.

Practical example:

- Moving $2,000 from a 25% card to a 0% balance transfer card saves $40-45 per month in interest.

- Refinancing a $5,000 personal loan at 22% APR into a credit union loan at 10% APR reduces payments by $60-70 per month.

- Avoiding payday loans that cost $15 per $100 borrowed prevents losses of $75-90 monthly.

Altogether, restructuring debt and avoiding predatory lending saves between $100-150 per month, while also building long-term credit strength. Financial advisors consistently recommend this as one of the top interventions for households living paycheck to paycheck.

Rethink Transportation Choices

(Average savings: $70-$180 per month)

Transportation is often one of the “big three” expenses (alongside housing and food) for families, so it offers big savings potential. On average, U.S. households spent about $13,174 on transportation in 2023, making it the second-largest yearly expense after housing. For lower-income families the burden is even greater - the poorest 20% of households spend roughly 32% of their income on transportation (despite often owning older or fewer vehicles). Owning and operating even a single car is expensive: AAA reports the average cost of a new car is over $12,000 per year (about $1,000 per month) when you factor in gas, insurance, maintenance, and depreciation. Therefore, downshifting your transport costs can yield substantial savings. Carpooling or using public transit a few days a week can save a typical commuter $60-$100+ in gas and parking. And in multi-car households, dropping an extra car can easily free up several hundred dollars per month in insurance, fuel, and upkeep. In urban areas, many financial counselors suggest budgeting for a transit pass or rideshares in lieu of a second car - it’s often far cheaper than keeping an underused vehicle on the road. The bottom line: optimizing transportation (through alternatives, more efficient vehicles, or insurance tweaks) can readily save $100+ per month, and also reduces surprise repair bills.

Why this works:

- Cuts fixed costs: dropping insurance and maintenance eliminates recurring obligations.

- Fuel efficiency: reducing solo driving saves $40-60 monthly in gas.

- Flexible alternatives: car-sharing services like Zipcar or community carpool apps reduce per-use expenses.

Practical example:

- Canceling a second vehicle insurance policy saves $70-100 per month.

- Switching from a 20-mile solo commute to a carpool splits costs, saving $60 monthly on gas.

- Using public transit instead of driving 3 days a week can save $90-120 per month, depending on city fares.

On average, transportation optimization frees $100-150 per month, and in urban areas with robust transit it may exceed $200. Financial planning experts consider transportation one of the “big three” categories - alongside housing and food - where savings have the largest and most reliable effect.

Lower Energy and Utility Costs

(Average savings: $40-$90 per month)

Simple home efficiency improvements can significantly cut monthly utility bills by 10-20% or more without reducing comfort. The U.S. Department of Energy’s Weatherization Assistance Program finds that insulating and weatherproofing a low-income home saves about $372 in energy costs per household each year on average - that’s over $30 per month in heating/cooling savings due to better efficiency. Even small fixes pay off: replacing old incandescent light bulbs with LEDs, for example, reduces electricity usage dramatically; the average household saves around $225 per year by using LED lighting in place of traditional bulbs.

Likewise, installing a programmable thermostat (or simply adjusting the thermostat a few degrees when you’re asleep or away) can trim roughly 10% off your heating and cooling bills annually - often $20 or more in savings each month. Many utility companies offer free or appliance power usage tracker and rebates for things like efficient appliances, smart thermostats, or weatherization. By taking advantage of these one-time upgrades (caulking drafts, adding attic insulation, upgrading to Energy Star devices, etc.), households typically reduce their utility bills by $50-$70 per month on average in the long run - savings that recur every month, year after year.

Why this works:

- Lower baseline usage: small adjustments cut monthly bills by 10-20%.

- One-time fixes, ongoing returns: weather-stripping or LED bulbs reduce costs every month without repeat effort.

- Eligible rebates: local programs often cover part of the upgrade cost.

Practical example:

- Replacing incandescent bulbs with LEDs lowers electricity bills by $10-15 monthly.

- Installing a programmable thermostat reduces heating or cooling costs by $20-30 monthly.

- Cutting phantom load (unplugging devices or using smart plugs) saves another $10-20.

Households that apply two or three efficiency steps usually reduce utility bills by $50-70 per month. Financial coaches highlight this category because it compounds - savings repeat every month with zero added effort.

We are recommend

Appliance Power Usage Tracker

Do you want to understand what your powewr bill consists of?? Built for practical households, the Appliance Power Usage Tracker translates appliance choices into monthly kWh and dollars with transparent math. The Results table ranks costs line by line and surfaces expert actions - set water heaters to 120°F, enable auto-sleep on computers, batch laundry with high-spin, and cook efficiently with lids or a microwave for small portions. Add any custom device in seconds. Revisit after two weeks to confirm savings.

Maximize Benefits and Community Programs

(Average savings: $100-$250 per month)

Fully leveraging available assistance programs can dramatically stretch a low income budget. For example, the Supplemental Nutrition Assistance Program (SNAP) helps millions afford food - in 2024, about 41.7 million Americans (12.3% of the population) received SNAP each month. The average SNAP benefit is roughly $192 per person per month, which means a low-income family of three might get around $576 monthly to cover groceries, directly offsetting what they would otherwise pay in cash. That easily translates to over $100-$150+ saved on food per month for a household, as mentioned in the article.

Similarly, the Low Income Home Energy Assistance Program (LIHEAP) can defray heating and electric bills: for instance, Illinois reported an average LIHEAP benefit of $686 per household during the 2024-2025 winter season, which would equate to around $50-$60 in monthly utility cost relief across the year. Families with children can also benefit from programs like childcare subsidies or the Child Tax Credit - these can reduce daycare or preschool costs by hundreds of dollars monthly, or provide annual tax refunds in the thousands, significantly easing the financial strain of child care.

Why this works:

- Immediate relief: benefits apply directly to core expenses (food, energy, housing).

- Scalable impact: programs can stack - for example, food assistance plus childcare subsidies.

- No repayment: unlike loans, assistance is permanent support.

Practical example:

- SNAP benefits save families $120-150 per month in grocery spending.

- LIHEAP (Low Income Home Energy Assistance Program) cuts heating bills by $40-60 monthly.

- Childcare credits reduce out-of-pocket daycare costs by $100-200 monthly.

On average, households that fully utilize benefits free up $150-200 per month in budget space. Verified by government data, these programs are designed as stabilizers and should be considered essential tools, not last resorts.

Checklist: Quick Actions to Start Saving Today

This is a short, actionable list you can print, copy to your notes app, or stick on your fridge. The idea is simple: mark each task as you complete it and capture the monthly savings right away.

Note: Each checked item translates into real money freed from your budget. Even completing just three actions today could give you an extra $100+ every month to redirect toward savings or debt payoff.

Real-Life Scenarios: Saving on a Low Income

Myths vs Facts About Saving on a Low Income

Saving on a low income is surrounded by misconceptions that discourage people from taking action. These myths often come from outdated advice, misinformation, or assumptions that only apply to higher earners. In practice, many of the most effective savings strategies are specifically designed for people working with limited resources. Breaking down myths with factual explanations is essential, because clarity empowers households to make confident financial decisions. The following table highlights six common myths and matches them with facts grounded in real financial counseling, consumer data, and proven outcomes.

|

Myth |

Fact |

|

“I don’t earn enough to save anything.” This myth assumes that saving requires large amounts, so small contributions are pointless. People repeat it when they see their paycheck disappear into rent and bills, believing there’s nothing left to redirect. The result is paralysis - no action, no buffer, and continued dependence on debt. |

Even small amounts matter. In practice, putting aside just $5-$10 per paycheck builds an emergency fund over time. Studies from the Consumer Financial Protection Bureau show that families with as little as $250 in savings avoid payday loans and overdrafts far more often. The habit counts more than the size - consistent micro-savings grow into meaningful protection. |

|

“Cutting out coffee or small treats will solve my problems.” This myth overemphasizes symbolic sacrifices, making people feel guilty over minor expenses while ignoring the big picture. It shifts focus away from major recurring costs. |

Target big wins, not small pleasures. Financial coaches recommend renegotiating internet, insurance, and housing costs before worrying about lattes. Dropping a $70 bill down to $50 frees $20 monthly - more than skipping 10 coffees. Structural savings create lasting change, while small pleasures kept in moderation improve sustainability. |

|

“I need to pay off all my debt before saving.” Many believe saving while in debt is pointless, since interest rates are higher than any savings return. This mindset keeps them exposed to emergencies without backup cash. |

Saving and debt repayment go together. Professionals advise building at least a mini emergency fund ($300-$500) before aggressive debt payoff. This prevents new borrowing when unexpected costs arise. Once the buffer is set, extra cash flows into debt reduction. The dual strategy stops cycles of debt while still lowering balances. |

|

“If I live paycheck to paycheck, saving is impossible.” People assume tight cash flow leaves no margin. This belief often comes from not tracking expenses or overlooking hidden leaks. |

Budget clarity reveals hidden dollars. When households map out every expense, patterns emerge - subscriptions not used, overpriced utilities, food waste. Redirecting even $50-$100 per month into savings is common after the first review. Tracking is not about restriction - it’s about visibility and control. |

|

“Government or employer programs are only for others.” Many skip benefits because they think they won’t qualify, or the process seems too complicated. This leaves money on the table every month. |

Programs exist to stabilize working families. SNAP, LIHEAP, childcare credits, and employer assistance are designed for low-to-moderate income households. On average, families using these programs reduce expenses by $150-$250 per month. Guidance is available through nonprofit financial counseling, making access far easier than assumed. |

|

“Saving requires financial apps and complex tools.” Some people avoid starting because they think they need advanced apps, spreadsheets, or expert-level knowledge. |

Simple systems are most effective. Professionals recommend starting with one no-fee savings account labeled “Emergency” and one basic transfer rule: move $5-$20 on payday. Apps and spreadsheets can come later, but simplicity ensures action. The most important tool is habit, not technology. |

What are the Best Free Resources to Save Money?

Saving effectively on a low income does not rely on guesswork - it relies on trusted tools that reduce costs and automate positive behaviors. These resources are widely used, recommended by financial advisors, and validated by millions of households. Each one addresses a different expense category: groceries, utilities, debt, or banking. The key is not to overload yourself with dozens of apps, but to select two or three that fit your life and use them consistently. Below are proven, reliable resources that deliver real savings.

-

Ibotta

It is one of the most popular cashback apps for groceries and household items. Users scan receipts or link loyalty cards to earn cash rebates on everyday purchases. Savings range from $10-$25 per month for households that shop weekly. The app is trusted by major retailers like Walmart and Target, making it reliable and widely applicable. It’s effective because it rewards normal spending behavior without requiring extra purchases. -

Mint

It is a free budgeting tool that connects to bank accounts and credit cards, automatically tracking expenses. It categorizes spending, highlights overspending areas, and sets savings goals. For low-income households, it reveals hidden leaks - like duplicate subscriptions or unused services - often worth $50-$100 monthly. Its strength lies in simplicity: the dashboard provides clarity, which is the foundation of all savings strategies. -

Energy Star

It offers guidance and certified products that reduce household utility costs. From LED bulbs to efficient appliances, the label ensures lower long-term energy bills. Many utilities partner with Energy Star to offer rebates, making upgrades affordable. Typical households see $20-$40 savings per month after simple swaps. Its credibility is backed by the U.S. Environmental Protection Agency, giving it high trust and authority. -

National Foundation for Credit Counseling

The NFCC connects people with certified nonprofit credit counselors who help restructure debt and build realistic budgets. Services include debt management plans, creditor negotiations, and financial education. For low-income families, this support eliminates late fees, reduces interest, and creates sustainable repayment schedules. Average monthly relief from interest and fees ranges from $50-$150, depending on the case. NFCC is widely recommended by financial experts because it combines expertise, transparency, and accessibility.

FAQ: How to Save Money on a Low Income

How to save money fast on a low income - proved 7 ways

Speed comes from attacking fixed costs and interest, not pennies. Use these seven field-tested moves and capture the savings into a separate “Emergency” account the same day. (1) Call internet/cell providers and switch to a retention plan: $30-$70/mo. (2) Cancel three low-use subscriptions after a 90-day statement review: $25-$45/mo. (3) Structured meal planning + store brands: $80-$120/mo. (4) Balance-transfer a 24-29% card to 0% APR for 12 months: $40-$70/mo on $2,000. (5) Raise insurance deductibles and bundle auto + renters: $20-$50/mo. (6) Commute shift - public transit or carpool 2-3 days/week: $60-$120/mo. (7) Thermostat ±2°F, LEDs, and a smart power strip: $20-$30/mo. Total fast savings typically exceed $250-$400/mo.

How can I save money on a low income if I live paycheck to paycheck?

Run a 3-step playbook used in financial counseling. Step 1: Stabilize cash flow. Open a no-fee checking account with low-balance alerts, align bill due dates to paydays, and automate minimums to stop late fees. Step 2: Capture obvious leaks. Renegotiate telecom and insurance, cancel low-use subscriptions, meal-plan once a week, and set thermostat schedules; this frees $150-$300/mo in most cases. Step 3: Build a mini buffer fast. Move $25-$50 per paycheck into a named savings account until it reaches $300-$500. That buffer prevents overdrafts and payday loans, which are the main reason paychecks never stretch. Track every win in a simple ledger - date, action, new bill amount, dollars freed - and transfer the delta on the same day.

What’s the fastest way to save money with low income?

Prioritize renegotiation and re-pricing over small sacrifices. One afternoon of provider calls often beats a month of skipped treats. Script: “I see better pricing from competitors; align my rate today.” Target internet, mobile, and insurance first; savings of $50-$150/mo land on the next bill. Next, remove interest drag: move high-APR balances to a 0% transfer card or a credit-union consolidation to free $40-$100/mo. Then fix groceries - the third big lever - with a weekly plan and store brands ($80-$120/mo). Close by eliminating bank fees and setting thermostat schedules ($40-$60/mo combined). Execute these four moves within 72 hours and redirect the total - often $250-$400/mo - into an “Emergency” account before it blends back into spending.

How much should I realistically save per month?

Set a laddered target that respects cash flow and still builds safety. Start with $25-$50 per paycheck until you reach $300-$500 as a mini emergency fund. Then raise contributions to 5% of take-home and automate transfers on payday to remove decision fatigue. Once debts above 15% APR are under control, step up to 10% of take-home and park it in a high-yield savings account. The first milestone is $1,000; the durable target is 1 month of essential expenses, then 3 months. This progression is considered realistic for low-income households because it stabilizes the present (fees and emergencies) while creating forward motion without starvation budgets.

Is it better to pay off debt or save first?

Use a dual-track approach that stops new debt while lowering existing balances. Sequence:

- Fund a $300-$500 mini emergency account immediately to cover small shocks.

- Keep all minimums on time to protect credit and avoid fees.

- Attack high-APR debt (20%+ first) using the avalanche method; add a 0% balance transfer or credit-union refinance to drop interest.

- Maintain automatic savings at a modest level ($25-$50 per paycheck) so the buffer keeps growing.

After high-APR balances shrink, raise savings toward 1 month of essentials. This structure is considered effective because it breaks the swipe-borrow-fee cycle while accelerating principal reduction.

What’s the 30-day savings rule and how can it help?

The 30-day rule creates a cooling-off period for non-essential purchases. Process: add the item to a “30-Day List,” record price and date, transfer the same amount to savings, and set a calendar reminder. After 30 days, buy only if it still passes a three-question test: Is it essential? Is there a cheaper substitute? Is the timing right relative to current goals? This rule reduces impulse spending, raises savings automatically, and preserves mental bandwidth because decisions happen on a schedule, not in the aisle. Households that apply it consistently redirect $50-$150/mo on average, especially when combined with a single weekly shopping window and no-spend weekdays.

Conclusion

Financial stability on a low income is considered a system, not a slogan. The highest leverage comes from structural moves - repricing bills, removing interest drag, and standardizing groceries and utilities - then capturing every saved dollar in a named account before it leaks back out. Real households use this order every week because it works under pressure and survives busy schedules. You now have a framework, a quick-start checklist, realistic numbers, and proof that progress compounds.

Pick one lever today, set a same-day transfer for the savings you create, and label the account “First $500.” When the balance reaches $300-$500, raise your automatic transfer by $5. Repeat monthly. This cadence builds safety, upgrades your negotiating power, and converts stress into options - on your terms, not the lender’s. Start now; your next bill is the first win.